Running a business is a tough job, and as a business owner, you know this all too well.

You’ve probably put in countless hours and made countless sacrifices to get where you are today. But as your business grows, it can be hard to keep up with everything on your own. That’s where a fractional COO comes in.

A fractional COO, or Chief Operating Officer, is a high-level executive who works with your business on a part-time or contract basis.

They are responsible for managing the day-to-day operations of your business, ensuring that everything runs smoothly and efficiently. And the best part? You get all the benefits of having a COO without the cost of a full-time employee.

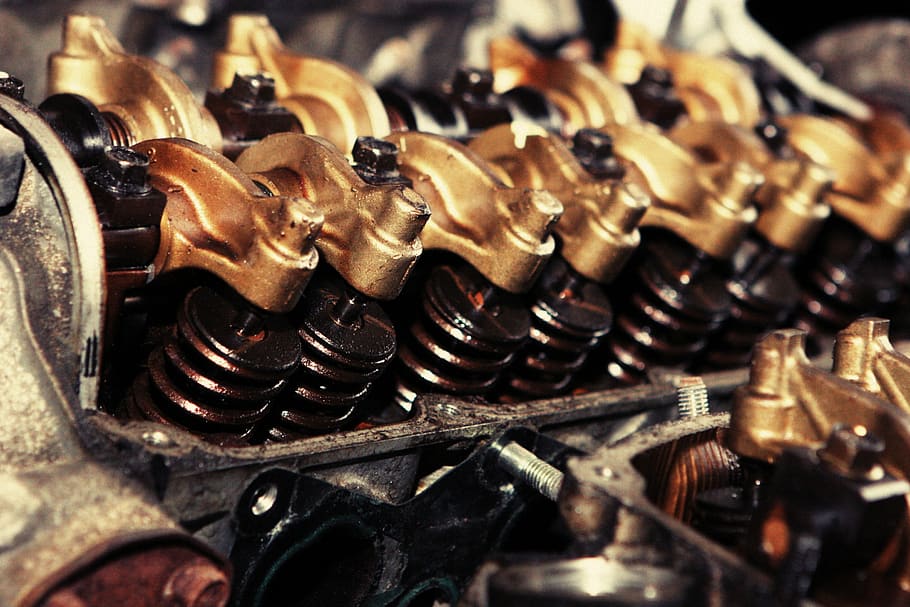

So how can a fractional COO turn your team into a well-oiled machine in a fraction of the time? Let’s take a look at some of the benefits:

- Strategy and Planning

One of the key roles of a COO is to develop and implement strategies and plans that align with your business goals. They work with your team to develop a roadmap for success, outlining the steps you need to take to achieve your objectives. This includes everything from market research to financial planning to resource allocation.

- Operations Management

A COO is responsible for managing the day-to-day operations of your business. They ensure that everything runs smoothly and efficiently, from production to logistics to customer service. They also develop processes and procedures to improve operational efficiency and reduce waste.

- Team Management

A COO is responsible for managing your team, ensuring that everyone is working together effectively and efficiently. They provide leadership, motivation, and support to help your team reach its full potential. They also identify areas where additional training or resources may be needed to improve performance.

- Financial Management

A COO is responsible for managing your finances, ensuring that your business is profitable and sustainable. They develop budgets, analyze financial data, and identify opportunities to improve revenue and reduce expenses. They also work with your team to develop pricing strategies, manage cash flow, and secure financing as needed.

- Risk Management

A COO is responsible for identifying and managing risks that could impact your business. They develop contingency plans to mitigate risks and ensure that your business is prepared for any eventuality. They also monitor industry trends and regulatory changes to ensure that your business remains compliant with all applicable laws and regulations.

Customer reviews of fractional COOs are overwhelmingly positive. They often mention the quick turnaround time and the efficiency of the COO’s work. One customer, a small business owner, said, “Our fractional COO helped us streamline our operations and reduce our costs. They were able to identify inefficiencies that we never would have seen on our own. We’re now more profitable than ever before.”

Another customer, the CEO of a mid-sized company, said, “Our fractional COO was a game-changer for our business. They helped us develop a long-term strategy that has allowed us to grow faster and more efficiently than we ever thought possible.”

In conclusion, a fractional COO can be a valuable asset to any business. They bring a wealth of knowledge and experience to the table, and they can help your team become more efficient and effective in a fraction of the time it would take to do it on your own.

So why not consider hiring a fractional COO for your business?

You may be surprised at how quickly your team can become a well-oiled machine.